Transformer Shortages: Supply Chain Impact on Pricing

Share

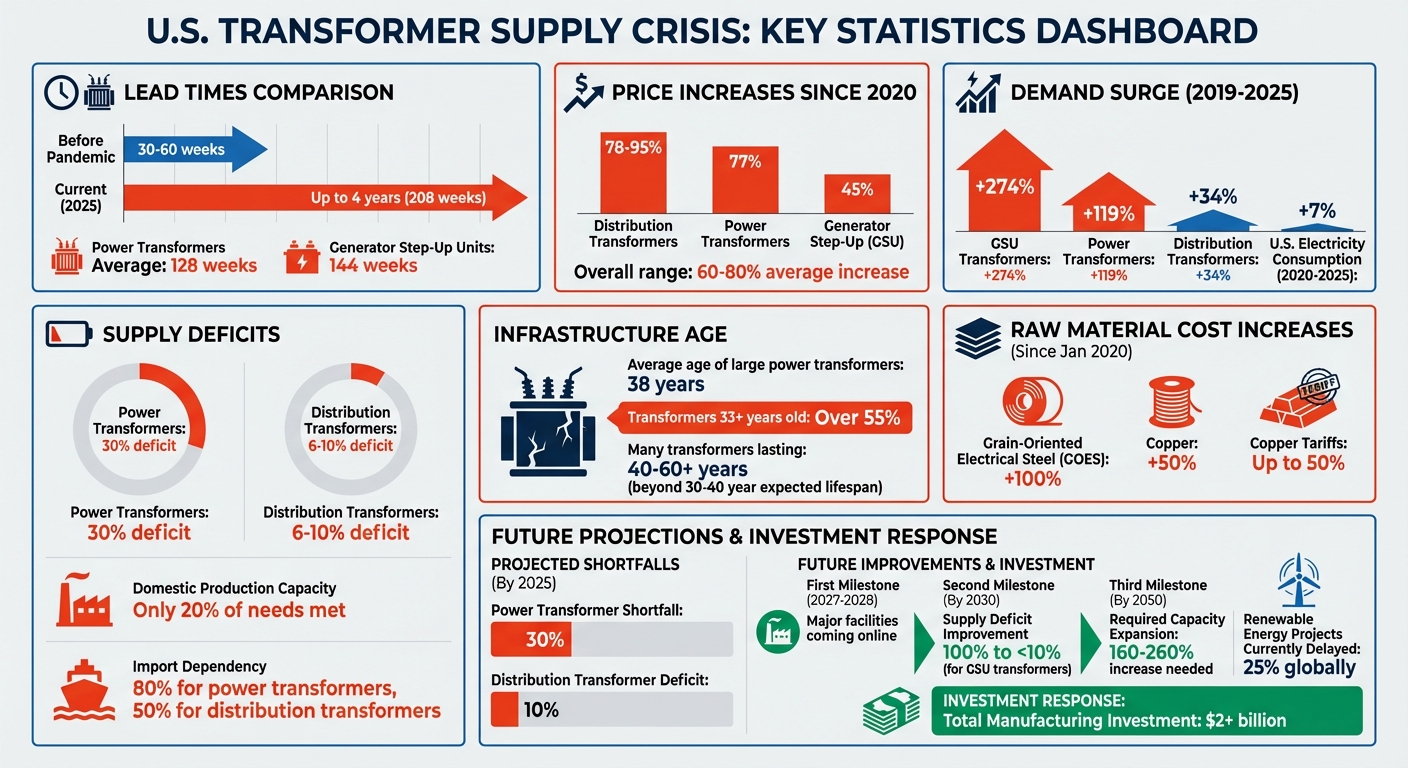

The U.S. is grappling with a severe transformer shortage, disrupting infrastructure projects and driving up costs. Lead times for power transformers have surged from 30–60 weeks pre-pandemic to as long as 4 years, with prices increasing 60%–80% since 2020. Aging grids, rising electricity demand, and the growth of EVs, renewable energy, and data centers are fueling demand, while manufacturing constraints and raw material shortages limit supply.

Key points:

- Demand Surge: Power transformer demand grew 119% since 2019; generator step-up units rose 274%.

- Price Increases: Distribution transformers now cost 78%–95% more; power transformers are up 77%.

- Aging Infrastructure: Over 55% of U.S. transformers are 33+ years old.

- Production Constraints: U.S. meets only 20% of its power transformer needs domestically.

While companies and governments are investing over $2 billion in new facilities, recovery will take years. For now, utilities must plan ahead, order early, and brace for higher costs.

U.S. Transformer Shortage Statistics: Lead Times, Price Increases, and Supply Deficits 2019-2025

The Current Transformer Supply Crisis

How Severe Is the Shortage?

The transformer supply crisis in the U.S. has reached a critical point. Domestic manufacturers are meeting only about 20% of the country’s power transformer needs. This leaves imports to fill the gap, covering 80% of power transformer demand and 50% of distribution transformer demand.

Looking ahead, the situation appears even more dire. By 2025, the U.S. could face a 30% shortfall in power transformers and a 10% deficit in distribution transformers. Lead times are stretching alarmingly, averaging 128 weeks for power transformers and 144 weeks for generator step-up units by Q2 2025. In some cases, orders are now taking up to four years to fulfill.

The rapid surge in demand has left the industry scrambling. Richard Voorberg, President of Siemens Energy North America, summed it up succinctly:

"I've been in this industry for 32 years... I've never seen something like this that is going up at such a rate that looks sustainable as well".

The National Renewable Energy Laboratory projects that, to meet electrification goals, the U.S. will need to expand transformer stock capacity by 160% to 260% by 2050. Globally, the problem is no less severe - about 25% of renewable energy projects are delayed due to transformer shortages.

This crisis boils down to a combination of skyrocketing demand and manufacturing bottlenecks.

What's Causing the Crisis?

A mix of factors has created what many are calling a "perfect storm". At the forefront is the unprecedented growth in demand. This spike is driven by several trends, including the rapid expansion of AI data centers and cryptocurrency mining, the rollout of EV charging networks, renewable energy projects, and the electrification of buildings.

Adding to this pressure is the aging infrastructure, which further increases demand for replacements and upgrades. Between 2020 and 2025, U.S. electricity consumption has risen by 7%, intensifying the strain on the grid.

On the production side, manufacturing constraints are a major hurdle. Transformers aren’t mass-produced - they require custom designs and skilled labor. On top of this, shortages of critical raw materials like grain-oriented electrical steel and copper have further limited production capacity. To make matters worse, a 50% duty on copper and expanded Section 232 duties on steel have driven up costs for both imported and domestically made transformers.

The combination of these factors - soaring demand, aging infrastructure, and supply chain challenges - has pushed the industry to a breaking point.

The electric transformer shortage

Why Transformer Demand Is Rising

The growing demand for transformers is putting immense strain on an already overburdened supply chain.

Aging Power Grid Upgrades

The U.S. power grid heavily relies on outdated equipment. On average, large power transformers are about 38 years old, and over half of distribution transformers are at least 33 years old. Killian McKenna, a researcher at the National Renewable Energy Laboratory, highlighted the issue:

"Assets that were expected to last 30 to 40 years are, in many cases, lasting 40, 50, and even over 60 years".

This aging infrastructure has sparked a wave of replacements. Utilities aren’t just swapping out old units - they’re upgrading to larger, more durable transformers. Additionally, there’s a shift from traditional pole-mounted transformers to pad-mounted or underground units, which are better suited to withstand wildfires and severe weather.

Renewable Energy and EV Charging Growth

The push for renewable energy is driving a sharp increase in transformer demand. Wind and solar projects rely on step-up transformers to convert low-voltage electricity into high-voltage power for long-distance transmission. Demand for generator step-up transformers has surged by 274% between 2019 and 2025, with these units expected to add 2 terawatts to grid capacity by 2050.

Electric vehicle (EV) infrastructure is adding even more pressure. Public EV charging stations typically require three-phase, oil-immersed transformers, while rising residential electricity use is pushing utilities to install larger single-phase units. Currently, about 25% of global renewable energy projects face delays due to long lead times for transformers.

Data Center Expansion

The rapid growth of data centers, fueled by AI and other digital services, is creating dense, high-load demands. These facilities often require specialized three-phase, dry-type transformers. Meanwhile, U.S. manufacturing construction spending has jumped 96% over three years ending in 2025, adding further strain to transformer production.

| Demand Driver | Growth (2019–2025) | Impact |

|---|---|---|

| Generator Step-Up (GSU) Transformers | 274% | Renewable energy integration |

| Power Transformers | 119% | Grid upgrades, data centers |

| Distribution Transformers | 34% | EV charging, electrification |

This surge in demand is worsening supply chain challenges, leading to rising transformer prices and manufacturing bottlenecks.

Manufacturing and Supply Constraints

The challenges in this sector are deeply rooted and can't be resolved quickly.

Raw Material Shortages

A key bottleneck lies in securing grain-oriented electrical steel (GOES) - the specialized material essential for transformer cores. In the U.S., Cleveland-Cliffs/AK Steel is the only domestic producer, leaving manufacturers heavily dependent on foreign markets or importing semi-finished cores from abroad. The situation isn't helped by soaring raw material costs: GOES prices have nearly doubled, and copper prices have jumped more than 40% since early 2020.

"Copper is becoming increasingly scarce because the demand for copper is accelerating rapidly beyond anyone's expectation".

The shortages extend beyond metals. Components like bushings and tap changers often face long lead times, becoming critical bottlenecks in production schedules. Wade Lauer, Senior Vice President of Grid Technologies at Siemens Energy, highlighted this issue, noting how these parts frequently determine overall lead times. Even insulating fluids and biodegradable cooling oils are in short supply, as utilities push for eco-friendlier alternatives.

Limited Production Capacity

Material shortages are only part of the problem - production capacity is also stretched thin. The U.S. manufacturing base currently meets just 20% of the nation’s transformer demand. This leaves the country heavily reliant on imports, with about 80% of large power transformers and 50% of distribution transformers sourced from overseas.

Scaling up domestic production isn't straightforward. Building new manufacturing facilities requires significant upfront investment, and it can take decades to break even. Skilled labor shortages compound the issue.

"It's skilled labor - there's a lot of manual labor in the windings of a transformer, and that's where people have failed in the past".

Customization further complicates matters. Utilities often request highly specific components, even for minor parts, which prevents manufacturers from adopting standardized, high-speed production methods. This lack of efficiency contributes to a 30% supply deficit for power transformers and a 6% to 10% deficit for distribution transformers.

Geopolitical and Supply Chain Disruptions

Global trade instability is adding more pressure to transformer supply chains. Tariffs on copper imports and expanded Section 232 duties on steel have driven up costs for both imported and domestically produced equipment. Meanwhile, stricter Foreign Entity of Concern (FEOC) regulations are forcing manufacturers to remove Chinese-linked materials from federally funded projects. This shift complicates sourcing, especially since the U.S. relies on a single domestic supplier (Metglas) for amorphous metal cores.

As of Q2 2025, lead times for large power transformers averaged 128 weeks, with some units requiring over four years to complete. With production slots fully booked, manufacturers are prioritizing high-volume orders over complex custom designs. These intertwined challenges are driving up transformer prices, setting the stage for further discussion later in the article.

sbb-itb-501186b

How Shortages Are Affecting Transformer Prices

Supply shortages have caused transformer prices to rise dramatically across the board. Since 2019, distribution transformers have seen price increases of 78–95%, power transformers are up 77%, and generation step-up (GSU) transformers have climbed 45%. In some cases, utilities have reported paying four to nine times what they historically did for transformers over just a few years. These sharp increases highlight the need to examine the factors driving these costs.

Rising Raw Material Costs

One of the biggest contributors to rising transformer prices is the surge in raw material costs. Since January 2020, prices for grain-oriented electrical steel (GOES) and copper - key materials in transformers - have jumped 100% and 50%, respectively. U.S. trade policies have added to the pressure, with tariffs on copper reaching as high as 50%. Prices for related equipment, like circuit breakers and medium-voltage switchgear, have also risen by 47% and 50%, respectively.

Even when raw material prices have temporarily dipped, suppliers have kept prices high to account for ongoing demand and extended lead times. According to Wood Mackenzie, "the market is expected to remain volatile moving forward amid capacity constraints and growing demand". This volatility in material costs has directly impacted transformer pricing.

Transformer Price Trends

Here's a snapshot of how transformer prices and supply dynamics have evolved since 2019:

| Transformer Type | Price Increase | Current Supply Deficit | Average Lead Time |

|---|---|---|---|

| Power Transformers | 77% | 30% | 128 weeks |

| GSU Transformers | 45% | – | 144 weeks |

| Distribution Transformers | 78–95% | 6–10% | Varies (Improving) |

These soaring costs and extended lead times are forcing utilities and developers to rethink their procurement strategies. Killian McKenna from the National Renewable Energy Laboratory explains, "Distribution transformers are a bedrock component of our energy infrastructure... but utilities needing to add or replace them are currently facing high prices and long wait times due to supply chain shortages. This has the potential to affect energy accessibility, reliability, affordability - everything". Furthermore, Wood Mackenzie estimates that around 25% of global renewable energy projects are now at risk of delay due to transformer shortages and the associated cost increases.

Regional Price Differences

Regional factors add another layer of complexity to transformer pricing. The U.S. depends heavily on imports, with about 80% of power transformers and 50% of distribution transformers sourced from overseas. Recent trade measures, such as "Liberation Day" actions, have increased import costs from key suppliers like Brazil, India, and China.

Adding to this, the U.S. market lacks standardization - utilities often require custom specifications, which prevents manufacturers from achieving economies of scale and raises costs further. Transportation logistics also play a role; moving massive transformers from coastal ports to inland locations is costly, especially since only around 10 specialized railcars in the U.S. can handle the largest units. Areas experiencing rapid data center growth or extreme weather events face even greater price pressures due to heightened demand.

Efforts to Address the Shortage

Nearly $2 billion has been directed toward boosting transformer production in North America. Companies like Hitachi Energy, Siemens Energy, GE Vernova, and Eaton are spearheading efforts to reduce reliance on imports by building large-scale domestic facilities.

Manufacturing Expansion Plans

Several ambitious projects are in motion. Hitachi Energy announced a $457 million investment in September 2025 to construct a facility in South Boston, Virginia. Once completed by 2028, it’s expected to become the largest transformer facility in the U.S.. Siemens Energy has also joined the effort, breaking ground on a $150 million transformer factory in Charlotte, North Carolina, in 2025, with production slated to begin by early 2027. Explaining the importance of these projects, Travis Edmonds, Vice President of Supply Chain at Hitachi Energy, stated:

"Building local capacity is critical to strengthening supply chain resilience".

Other companies are following suit. MGM Transformers and VanTran Transformers opened a 30,000-square-foot facility in Waco, Texas, in April 2025. Prolec GE completed a $29 million expansion of its Shreveport, Louisiana plant in 2024, increasing its capacity to support wind and solar projects by June of that year.

However, these initiatives won’t solve the problem overnight. According to Wood Mackenzie, the supply deficit for generation step-up transformers, which was around 100% in 2025, is projected to drop below 10% by 2030 as these new facilities ramp up production. Challenges like shortages of grain-oriented electrical steel and a lack of skilled labor continue to slow progress. Despite this, these private investments are paving the way for additional government involvement.

Government and Private Sector Initiatives

The federal government is stepping up to complement private sector efforts. Industry groups are advocating for $1.2 billion in funding to improve grid reliability and address supply chain bottlenecks. The government has also invoked the Defense Production Act to expand domestic production. In April 2024, the Department of Energy finalized new efficiency standards, giving manufacturers a five-year compliance window and allowing 75% of the market to continue using grain-oriented electrical steel. U.S. Secretary of Energy Jennifer M. Granholm commented:

"Ultimately, it [the final rule] will be a piece of the solution, rather than a barrier, to help resolve the ongoing distribution transformer shortage and keep America's businesses and workers competitive".

Private companies are also taking bold steps. Cleveland-Cliffs announced a $150 million project in July 2024 to transform a closed plant in Weirton, West Virginia, into a distribution transformer manufacturing hub, aiming to secure the supply chain through vertical integration. Similarly, ABB Installation Products opened a $40 million, 90,000-square-foot facility in Albuquerque, New Mexico, in April 2025. This facility uses robotics and automation to double production capacity for grid-hardening components.

While these combined efforts from the public and private sectors aim to stabilize the market, the challenges won’t disappear immediately. Wood Mackenzie predicts transformer prices will continue rising through 2030. Utilities and developers should expect higher costs and longer lead times for the foreseeable future, even as new capacity and federal support gradually alleviate the strain.

Conclusion

The transformer shortage has been driven by a mix of aging infrastructure, growing demand from data centers and renewable energy projects, and limited manufacturing capacity. As a result, lead times have stretched to an astonishing 144 weeks, and distribution transformer prices have surged by as much as 95%. These issues have prompted major responses across the industry.

Over $2 billion is being invested in manufacturing expansions, with facilities from companies like Hitachi Energy and Siemens Energy slated to come online by 2028. According to Wood Mackenzie, the supply deficit is expected to shrink significantly - from 100% in 2025 to less than 10% by 2030. However, ongoing challenges with raw materials and labor shortages mean that this recovery will take time.

In the meantime, utilities and developers are grappling with higher costs and extended wait times. To avoid delays that can span years, early procurement has become essential, forcing teams to place equipment orders well in advance.

Diversifying sourcing strategies is also key. Platforms like Electrical Trader provide access to both new and used transformers, offering a way to sidestep some of the current bottlenecks. This complements broader manufacturing expansions and policy measures aimed at addressing the crisis.

For now, procurement teams must adjust to these new realities - longer timelines and increased costs - to ensure infrastructure projects stay on track.

FAQs

What is causing the current transformer shortage and its impact on pricing?

The transformer shortage stems from a mix of supply chain disruptions, rising demand, and manufacturing constraints. Years of limited investment in U.S. manufacturing have led to significant backlogs, with transformer orders now taking as long as two years to complete. On top of that, surging material and production costs have driven equipment prices up several times over in recent years.

Policy restrictions and global manufacturing hurdles have only made the situation worse. The push for infrastructure upgrades, renewable energy projects, and handling higher power loads has outpaced the production capacity of domestic manufacturers. This imbalance is not just slowing down procurement but is also putting the stability and reliability of the power grid at risk.

How are transformer shortages affecting infrastructure project costs and timelines?

The U.S. is grappling with a serious transformer shortage that's causing delays and driving up costs for infrastructure projects. Transformer lead times have now stretched to as long as two years, while prices have skyrocketed - rising anywhere from four to nine times their previous levels. This combination of delays and cost increases is slowing down much-needed upgrades to the power grid and other critical infrastructure.

These supply chain issues are hitting utilities and contractors especially hard. Transformers are essential for expanding and maintaining transmission systems, but with demand far exceeding supply, project budgets are spiraling, and timelines are being extended. The ripple effects are being felt across the energy and construction industries, complicating efforts to meet growing energy needs and improve infrastructure reliability.

What is being done to resolve transformer supply chain shortages?

Efforts to tackle transformer supply chain shortages are coming from both the government and private sector. The U.S. government has taken action by invoking the Defense Production Act, which focuses on boosting domestic production of transformers and their components. This move aims to cut down reliance on imports and enhance the resilience of the power grid. On the industry side, manufacturers are stepping up by investing in new facilities across the country to increase production capacity.

Meanwhile, the Department of Energy is working closely with utilities, manufacturers, and federal partners to explore long-term solutions. These include strategies to improve supply chain reliability and initiatives to share transformer reserves among utilities. Together, these efforts are focused on strengthening the U.S. supply chain and creating a more stable transformer market in the years ahead.