Supply Chain Delays from Energy Policy Changes

Share

The U.S. energy transition is driving up demand for power grid equipment, creating severe supply chain delays. Transformers, breakers, and cables - critical for renewable energy projects and EV infrastructure - face lead times stretching to years. Prices have surged, with transformers costing 4-6 times more than in 2022. Regulatory changes, tariffs, and material shortages further complicate manufacturing.

Key takeaways:

- Transformer shortages: Lead times now exceed 3-4 years.

- Rising costs: Transformer prices have multiplied since 2022.

- Policy impact: New efficiency rules and tariffs slow production.

- Solutions: Stockpiling, standardization, and domestic manufacturing incentives can help mitigate delays.

The energy shift is vital but comes with high costs and logistical challenges. Addressing these supply chain bottlenecks is crucial to meeting climate goals and maintaining grid reliability.

The Problem: Supply Chain Delays from Energy Policy Changes

Policy Changes Affecting Supply Chains

Recent changes in energy policies have caused significant disruptions in equipment manufacturing. In April 2024, the Department of Energy (DOE) finalized updated energy efficiency standards for transformers, with a compliance deadline of April 23, 2029. Initially, the proposal required manufacturers to shift 95% of transformer cores from Grain-Oriented Electrical Steel (GOES) to amorphous alloy materials, which are in limited domestic supply. However, the finalized rule allows for 75% GOES usage, which helps maintain some production stability. Even so, manufacturers still face the challenge of retooling facilities and retraining workers to meet the new requirements.

To address these challenges and sustain domestic production, the government has taken steps like invoking the Defense Production Act in June 2022 and awarding a $75 million grant to Cleveland-Cliffs Butler Works in Pennsylvania. Despite these efforts, the regulatory changes have lengthened lead times and added layers of complexity to production.

Effects on Power Distribution Equipment

The ripple effects of these policy changes are most evident in the availability of power distribution equipment. Delivery times for distribution transformers have ballooned from the pre-2022 norm of 12 to 16 weeks to an astonishing 120 to 210 weeks as of now. Other critical components, like circuit breakers and power distribution cables, have also been delayed, but transformers remain the most pressing issue. The push for higher-efficiency cores has created a dependency on specialized electrical steel, which only a limited number of domestic facilities can produce at scale. Compounding the issue, the demand for transformer installations is expected to triple by 2050, further straining an already overwhelmed supply chain.

"The final rule balances lower energy costs, national security, and grid resiliency." – Marcy Kaptur, U.S. Representative (OH-09)

Higher Costs and Production Bottlenecks

Longer lead times have driven up costs, creating severe production bottlenecks. Transformer prices have skyrocketed, increasing by 4 to 6 times since 2022. This cost surge has forced many projects - once financially viable - either to secure additional funding or face outright cancellation. The delays are particularly problematic for renewable energy projects and data center expansions, both of which depend on timely transformer installations to connect to the grid. Maintenance schedules have also suffered as delayed deliveries create backlogs.

While the DOE’s new efficiency standards are projected to save $824 million annually in electricity costs once fully implemented, the transition period is proving expensive. Manufacturers are hesitant to expand capacity due to lingering regulatory uncertainty, further exacerbating the bottlenecks.

sbb-itb-501186b

The Quest Towards Next-Generation Resilient and Sustainable Energy and Manufacturing Supply Chains

Solutions to Reduce Supply Chain Delays

Addressing delays in the supply chain requires a mix of strategic approaches, especially as manufacturers and utilities face challenges from policy-driven disruptions. Here’s how to tackle these issues effectively:

Use Online Marketplaces to Expand Sourcing Options

Online marketplaces provide a faster way to access electrical inventory by connecting buyers directly to available stock. Platforms like Electrical Trader offer a wide range of new and used components, such as breakers, transformers, and switchgear, while also providing transparency throughout the supply chain. This transparency helps procurement teams quickly locate and secure the items they need.

Digital sourcing also encourages businesses to explore beyond their regular suppliers. By leveraging categorized listings and curated collections, teams can tap into secondary and tertiary suppliers. This is particularly important, as 98% of electric power executives cite logistics and component shortages as significant challenges to their operations. Adding blockchain technology to these platforms further enhances trust by enabling verified tracking of equipment origins and delivery updates.

While diversifying sourcing is crucial, stockpiling and standardization can provide an additional buffer against delays.

Stockpile Equipment and Standardize Designs

Keeping an inventory of essential equipment can help offset unpredictable lead times. Programs like those offered by Grid Assurance provide subscription-based access to bulk equipment stockpiles, ensuring utilities have what they need during shortages. As Dave Rupert, CEO of Grid Assurance, notes:

"I think there's going to be more oversight and scrutiny on utilities, and I think the ratepayers are really concerned about the costs."

Standardizing designs can also streamline production. For instance, modular transformer technologies that work across multiple voltage levels reduce the need for highly customized units. With over 90% of U.S. electricity passing through large power transformers, adopting standardized specifications can help manufacturers speed up production and lower costs.

Beyond sourcing and stockpiling, tapping into domestic resources can strengthen supply chain resilience.

Leverage Government Incentives for Domestic Manufacturing

The federal government has rolled out various initiatives to boost domestic production. In June 2022, President Biden invoked the Defense Production Act Title III to ramp up the manufacturing of electric grid transformers and components. Additionally, the Department of Energy (DOE) launched an $18 million Flexible Innovative Transformer Technologies (FITT) funding program to encourage advancements in grid technology.

Keeping an eye on DOE grants and loan opportunities can open doors for funding. These efforts align with federal goals to reduce emissions by 50% by 2030 and achieve a carbon-free power sector by 2035, funneling significant resources into clean energy technologies made in the U.S.. As the DOE explains:

"DOE recognizes that a secure, resilient energy supply chain will be critical in achieving these goals and capturing the economic opportunity inherent in the energy transition."

While new production ramps up, optimizing existing infrastructure can offer an immediate solution.

Retrofit and Optimize Existing Infrastructure

Upgrading current equipment can fill the gap while waiting for new components. Tools like the Reconductoring Economic and Financial Analysis (REFA) help utilities enhance transmission lines with advanced conductors, reducing the need for immediate transformer replacements. Designing equipment with repairability in mind and using strategic oversizing can also lower replacement rates and minimize exposure to supply chain delays.

Another game-changer is digital twin technology. By providing real-time tracking and predictive maintenance, digital twins help utilities anticipate and prevent equipment failures. This proactive approach is especially vital, given that lead times for large power system equipment have ballooned from 16–20 months to 20–39 months in just one year. Investing in such technologies can help utilities stay ahead of potential disruptions.

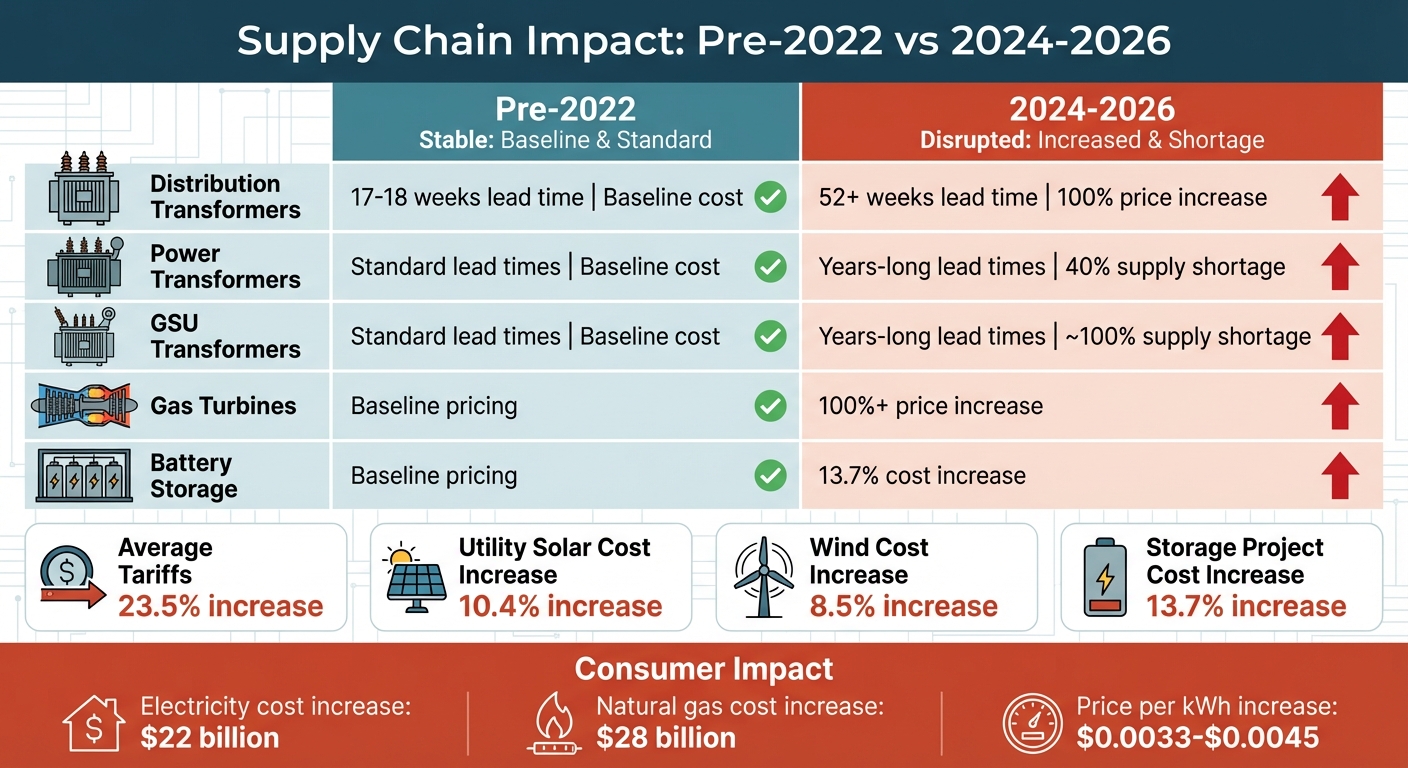

Comparison Table: Supply Chain Metrics Pre-2022 vs. 2024-2026

Supply Chain Equipment Lead Times and Cost Changes: Pre-2022 vs 2024-2026

Equipment Type, Lead Times, and Costs

The shifts in lead times and costs over the past few years highlight the challenges facing supply chains today. Before 2022, lead times were predictable and costs were stable. Fast forward to 2025, and the landscape looks very different. Benjamin Boucher, Senior Analyst at Wood Mackenzie, puts it into perspective:

"Lead times for key equipment remain challenging. Generation step-up transformers (GSUs) and power transformers are the biggest bottlenecks, with delivery times still measured in years."

For example, the lead times for distribution transformers have jumped from roughly 17–18 weeks to more than 52 weeks, with prices doubling compared to pre-2022 levels. Gas turbines also saw prices more than double. Meanwhile, GSU transformers are expected to face a nearly 100% supply shortage by 2025, and power transformers are projected to be 40% short of demand.

Trade policies have further complicated the situation, with tariffs now averaging 23.5%. According to Wood Mackenzie:

"Current tariffs have already raised storage project costs by 13.7%, utility solar by 10.4%, and wind by 8.5%."

| Equipment Type | Pre-2022 Lead Time/Cost | 2024-2026 Lead Time/Cost | Key Policy Factor |

|---|---|---|---|

| Power Transformers | Standard lead times; baseline costs | Lead times measured in years; 40% supply shortage | Defense Production Act Title III; tariffs on core materials |

| GSU Transformers | Standard lead times; baseline costs | Lead times measured in years; ~100% supply shortage | Trade policy volatility; 23.5% average tariff |

| Distribution Transformers | 17–18 weeks; baseline costs | 52+ weeks; 100% price increase | IRA-driven grid demand; DPA invocation |

| Gas Turbines | Baseline market pricing | Prices increased by over 100% | Data center demand surge; production bottlenecks |

| Battery Storage | Baseline market pricing | 13.7% cost increase | Foreign Entity of Concern rules; Chinese supply restrictions |

These supply chain delays aren't just numbers on a page - they directly impact consumers. Bottlenecks in infrastructure are predicted to push electricity and natural gas costs up by $22 billion and $28 billion, respectively. Electricity prices alone are expected to increase by $0.0033 to $0.0045 per kWh. These figures underline how supply chain disruptions lead to higher costs for consumers and create uncertainty for projects, reinforcing the importance of strategies aimed at addressing these challenges.

Conclusion: Managing Supply Chain Challenges During Policy Changes

The insights and strategies outlined above make one thing clear: navigating supply chain disruptions caused by shifting energy policies demands a proactive and strategic approach. These changes have significantly impacted the electrical supply chain, with lead times tripling and costs doubling, creating a pressing risk of critical equipment shortages.

To tackle these challenges, businesses can focus on diversifying their sourcing, stockpiling essential components with up to 52-week buffers, and standardizing equipment designs to streamline costs and speed up replacements.

In addition to these measures, online platforms like Electrical Trader offer a practical solution for sourcing both new and used electrical components. These platforms help businesses bypass traditional production delays by providing immediate access to items like transformers, breakers, and power distribution equipment - critical tools for maintaining operations.

Deloitte puts it succinctly:

"Supply chain disruptions will likely continue to occur, possibly with higher frequency. It is therefore increasingly important for the electric power sector to build resilient supply chains."

FAQs

How do changes in energy policies affect the transformer supply chain?

Shifts in energy policies, like when the Biden administration invoked the Defense Production Act (DPA) in 2022 to boost domestic transformer production, have had a major impact on the supply chain. Although the DPA aimed to ramp up U.S. manufacturing, lead times for new distribution transformers have jumped dramatically - from the previous 3–6 months to a staggering 1–2 years today. For large-power transformers, the wait is even longer, often exceeding two years. On top of that, tariffs on imported steel and copper have pushed component costs higher, with large-power transformers now often priced over $10 million.

These challenges expose deep structural issues. For instance, more than 80% of large-power transformers installed in 2019 were imported. This heavy reliance on imports means that changes in trade policies or disruptions in foreign supply chains can lead to even longer delays and higher costs. Compounding the problem, limited domestic production capacity and ongoing labor shortages make it harder to meet the growing demands of the electricity grid, which is expected to expand transmission capacity by 60% by 2030.

To help address these delays, platforms like Electrical Trader provide a centralized marketplace for both new and used transformers. These platforms allow utilities and developers to tap into available inventory, easing bottlenecks and keeping projects moving across the U.S.

How can utilities and contractors address supply chain delays and rising costs in power grid equipment?

Delays in the supply chain and rising costs for grid equipment often stem from a combination of high demand and limited production capacity for critical components like transformers and high-voltage conductors. To tackle these issues, the U.S. government has taken proactive measures, including invoking the Defense Production Act to ramp up domestic manufacturing. They've also explored creating strategic reserves of standardized transformers, aiming to stabilize pricing and cut down on transportation expenses.

Experts suggest a range of strategies to ease these bottlenecks. Using digital tools to improve supply chain visibility can help identify potential delays early. Diversifying suppliers - by working with both domestic and international vendors - reduces dependency on a single source. Locking in long-term contracts is another way to manage fluctuating prices. Additionally, standardizing component designs and adopting modular systems can provide flexibility, allowing interchangeable parts to be used when delays occur.

For a more immediate solution, utilities and contractors might consider turning to specialized marketplaces like Electrical Trader. These platforms offer access to both new and surplus electrical equipment, including transformers and breakers. By tapping into existing inventories, companies can reduce lead times and acquisition costs, making it a practical way to address supply chain hurdles.

Why is specialized electrical steel crucial for transformer production?

Transformers rely heavily on grain-oriented electrical steel (GOES) due to its exceptional magnetic properties, making it perfect for efficient power conversion. GOES stands out by reducing energy loss and overheating, thanks to its high magnetic permeability and low hysteresis loss - qualities that are essential for both distribution and large power transformers.

However, this dependence on GOES exposes the supply chain to potential disruptions in its production. Since many transformers in the U.S. are manufactured using imported materials, factors like shifts in energy policies, tariffs, or global events can result in delays and higher costs. Platforms such as Electrical Trader offer a practical solution by providing a centralized marketplace to source critical components domestically, helping to ease supply chain challenges.