Power Transformer Pricing Trends: A 10-Year Overview

Share

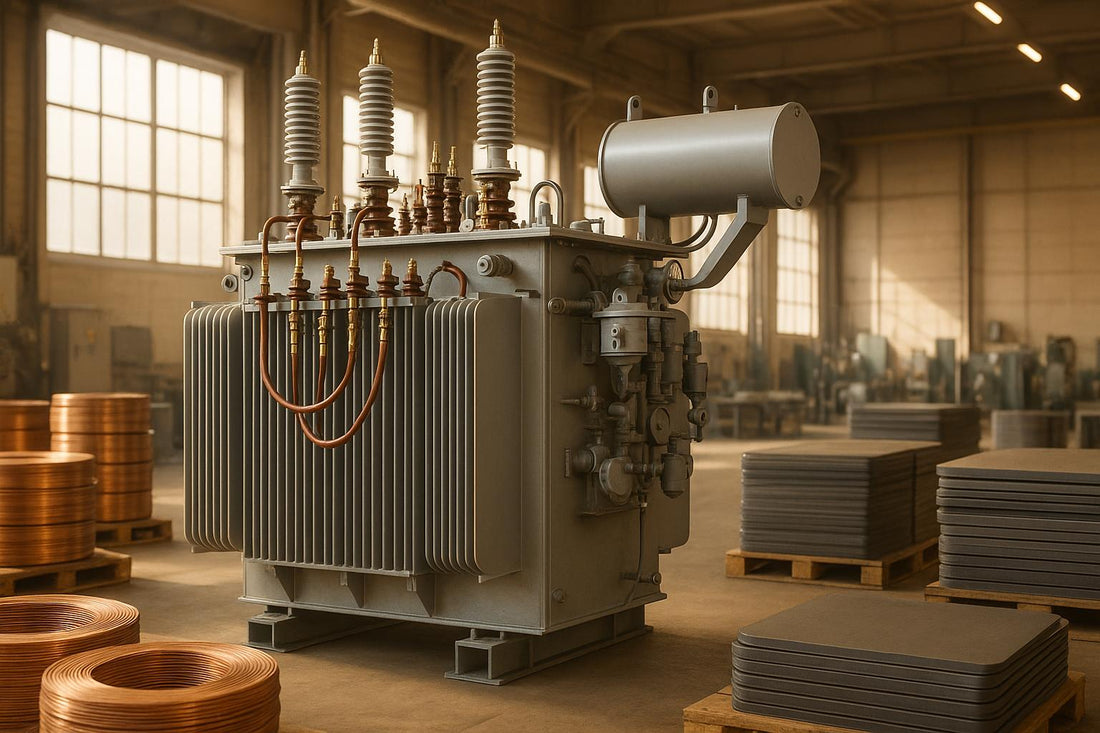

Power transformer prices have surged 60–80% since 2020, and lead times have stretched from 50 weeks in 2021 to as much as 210 weeks by 2024. Aging infrastructure, rising material costs, and growing demand for renewable energy are driving these changes, creating challenges for utilities and project developers.

Key Points:

- Price Increases: Transformer prices have risen sharply due to higher copper and steel costs, efficiency standards, and supply chain issues.

- Material Costs: Copper prices jumped to $9.51/kg in 2025 (up from $1.54/kg in earlier years). Steel prices spiked by 82% in 2021 but eased slightly in 2025.

- Technology Impact: Efficiency regulations and smart transformer advancements have raised production costs.

- Delays: Delivery times for larger units now exceed 4 years, threatening renewable energy project timelines.

- U.S. Market Challenges: 55% of U.S. transformers are nearing the end of their lifespan, with over 80% of large transformers being imported.

- Global Growth: The Asia-Pacific region leads growth, while North America faces supply constraints. The global transformer market is projected to grow from $27.9 billion in 2024 to $37.7 billion by 2029.

For buyers, platforms like Electrical Trader can help navigate these challenges by offering access to both new and used transformers.

| Region | Market Challenges | Growth Drivers |

|---|---|---|

| North America | Aging infrastructure, imports | Grid upgrades, renewable energy demand |

| Asia-Pacific | Rapid demand growth | Urbanization, electrification |

| EMEA | Supply chain improvements | Energy reforms, efficiency-focused upgrades |

Understanding these trends is crucial for planning and budgeting in today's transformer market.

Transformers: Pricing, Procurement, and Best Practices

Main Factors Affecting Power Transformer Prices (2015–2025)

The cost of power transformers has seen a steady rise over the past decade, driven by fluctuating raw material prices, evolving technology standards, and supply chain challenges. These factors have not only increased prices but also extended delivery times, reshaping the market landscape.

Raw Material Cost Effects

The volatile prices of copper and steel have played a major role in driving up transformer costs between 2015 and 2025. Gerry Yurkevicz, managing director of the worldwide Energy Group at Global Insight, explains:

"We view transformer prices as a function of both production costs and market activity, where costs are assumed to exert the dominant influence over transformer prices through time."

Copper prices have been particularly unstable. In earlier years, copper was priced at approximately $1.54 per kilogram, significantly below its historical average of $2.42 per kilogram. By June 2025, global copper prices soared to $9.51 per kilogram - a 1.5% increase over the prior period. In North America, prices reached $9.63 per kilogram, while in Northeast Asia, they climbed to $10.49 per kilogram. The global copper market itself expanded from $110 billion in 2020 to an anticipated $155 billion by 2025, reflecting a compound annual growth rate of 7.2%.

Steel prices have followed a similar rollercoaster. Between Q1 2020 and Q1 2021, structural steel costs jumped by 43%, with an additional 82% spike by the end of 2021. However, recent trends show a slight easing, with prices dipping 4.56% since January 2025 and a year-over-year decline of about 10.5%. These rising material costs, coupled with growing demand in regions like Asia and the Middle East, have further fueled transformer price hikes.

These raw material trends are only part of the story, as technological advancements have also added to production costs.

Technology Changes and Efficiency Gains

The introduction of updated efficiency standards in 2016 by the Department of Energy (DOE) significantly impacted transformer production costs. These standards increased efficiency requirements to between 98.70% and 99.55%, compared to the 2010 range of 98.36% to 99.49%. Meeting these new benchmarks required higher-grade materials, such as premium steel and copper, leading to cost increases.

According to data from Maddox Industrial Transformer, the cost of new 3-phase liquid-filled transformers rose by an average of 16.5% between 2015 and 2016. For instance, a transformer with a 225 kVA rating that cost $7,100 in 2015 jumped to $8,000 in 2016 - a 12.7% increase. Larger, higher-rated transformers experienced similar price escalations, highlighting the financial impact of these efficiency improvements.

Looking ahead, proposed DOE standards for 2027 are expected to mandate the use of amorphous steel cores in nearly all transformers, replacing traditional grain-oriented electrical steel. Industry projections suggest this shift could drive transformer prices up by 50–125% or more. On top of this, advancements in smart transformer technology - such as IoT sensors and digital monitoring systems - are further increasing costs while offering features like enhanced performance and predictive maintenance.

These technological shifts are occurring alongside significant supply chain challenges.

Market and Supply Chain Issues

Supply chain disruptions have made transformers harder to source and more expensive to purchase. Peter Ferrell, Director of Government Relations at the National Association of Electrical Manufacturers (NEMA), describes the situation:

"Delivery of a new transformer ordered today could take up to three years. Five years ago, that wait time was four to six weeks."

The COVID-19 pandemic exacerbated these challenges, slowing raw material supplies. During this time, the cost of Grain Oriented Electrical Steel (GOES) doubled, and copper prices rose by about 50%.

Demand surges from renewable energy projects and electric vehicle (EV) infrastructure have added further pressure. In the U.S., demand for distribution transformers is projected to grow by 260% by 2050 compared to 2021 levels, as 55% of existing transformers are over 33 years old. Global trade policies and rising shipping costs have also complicated the market, with copper prices remaining highly sensitive to policy shifts and trade tensions. These combined factors have contributed to an overall transformer price increase of 60–80% since January 2020.

For buyers navigating this challenging landscape, platforms like Electrical Trader offer access to both new and used electrical equipment, helping mitigate some of the cost and supply chain issues.

Price History by Transformer Type

Over the past decade, the prices of transformers have varied significantly depending on their type, largely influenced by market demand and application. Let’s take a closer look at the pricing trends for distribution and power transformers.

Distribution Transformers

Since 2015, prices for distribution transformers have steadily climbed across all categories. Single-phase overhead distribution transformers, for instance, maintained relatively stable prices between 2015 and 2018, with costs ranging from $700 to $3,500, depending on their kVA ratings. During this period, the median price hovered between $1,600 and $2,500.

Meanwhile, three-phase and padmount distribution transformers commanded higher prices due to their greater complexity and capacity. Between 2015 and 2018, bid prices for these units ranged from $3,500 to $12,000, varying based on order size and kVA specifications. By mid-2019, larger distribution transformers in the 1-25 MVA range were priced at $30,000 to $40,000 per MVA.

Post-2020, the market saw a sharp price surge, with costs increasing by 70-100%, primarily due to higher material expenses. This shift significantly impacted the market, with the U.S. distribution transformer market valued at around $3 billion in 2018 and global projections showing growth from $26.1 billion in 2024 to an estimated $51.3 billion by 2034.

The Asia-Pacific region has emerged as a key player, accounting for 45.6% of the global distribution transformer market share in 2024, valued at approximately $11.9 billion. This dominance has influenced global pricing and supply chain strategies.

Power Transformers by Size

Power transformers have followed their own pricing trends, primarily shaped by their capacity. These transformers are typically divided into three capacity segments: 100-500 MVA, 501-800 MVA, and 801-1,200 MVA.

The 100-500 MVA segment has been the most prominent, representing 63.8% of the market share in 2022 and projected to grow to 64.3% by 2025. This segment has also seen the fastest growth rate from 2023 to 2030, driven by global industrialization and urbanization.

Richard Voorberg, president of Siemens Energy North America, described the current market dynamics as unprecedented:

"I've been in this industry for 32 years, and I've seen booms and busts in our industry. I've never seen something like this that is going up at such a rate that looks sustainable as well."

Larger capacity transformers (501 MVA and above) have faced steeper price increases due to specialized production requirements and extended delivery times. The high capital investments needed for these units have become a significant challenge for the market.

Globally, the power transformer market has experienced robust growth, expanding from $22.83 billion in 2022 to a projected $38.91 billion by 2030. Some forecasts suggest even higher growth, with market values potentially reaching $54.25 billion by 2032.

To meet growing demand, manufacturers are ramping up production. In February 2024, Siemens Energy announced a $150 million investment to expand its Charlotte, North Carolina factory, aiming to produce 57 large power transformers per year with a total capacity of 15,000 MVA by 2026. Similarly, Hitachi Energy committed over $1.5 billion in April 2024 to boost global transformer manufacturing capacity by 2027.

For buyers, rising prices have been particularly challenging, as increases in the costs of electrical steel and copper are often passed directly to purchasers. To navigate these conditions, platforms like Electrical Trader offer access to both new and used transformers across various capacities.

sbb-itb-501186b

U.S. Market Data and Regional Comparisons

After examining global influences, let’s focus on the key factors shaping transformer pricing in the U.S.

U.S. Market Factors

The U.S. power transformer market is grappling with aging infrastructure. According to a 2022 DOE report, 70% of grid transmission lines and transformers are over 25 years old. This aging network has created an urgent need for replacements, driving up costs.

Utility spending on electricity delivery has surged - 68% higher in 2020 compared to 2010. In some states, like California, delivery costs can make up nearly 50% of retail energy bills. Meanwhile, the U.S. has ambitious goals to boost renewable energy, aiming for 80% of its generation mix by 2030 and 100% by 2035. By the end of 2022, over 10,200 projects were queued for grid interconnections, representing 1,350 GW of generation capacity and about 680 GW of storage. Meeting these goals requires significant transformer upgrades to support new connections and shifting power distribution needs.

Weather events are also influencing the market. Utilities are increasingly replacing pole-mounted transformers with more durable pad-mounted units to withstand extreme conditions.

Another critical issue is supply chain reliance. In 2019, over 80% of large power transformers were imported, making the U.S. vulnerable to global supply disruptions. Wood Mackenzie highlights the manufacturing challenges:

"Given the high start-up cost and skilled labor requirements of transformer manufacturing, it is unlikely that we will see any reshoring or expansion of the domestic manufacturing base absent incentives."

Currently, lead times for transformers range from 115 to 210 weeks, requiring utilities to plan far in advance.

U.S. vs Global Market Comparison

While the U.S. faces unique challenges, global markets have their own dynamics. North America remains the leading region in the global power transformer market, projected to hold a 41.7% share by 2025. However, this dominance comes with hurdles.

The transformer shortage is more severe in North America compared to Europe, largely due to a weaker local supply chain and import restrictions. European customers often commit to long-term agreements - up to 10 years - while U.S. commitments are generally shorter, adding to supply chain uncertainty.

Raw material costs also vary across regions. Paul DeCotis, senior partner at West Monroe, notes a growing strain on copper supplies:

"Copper is becoming increasingly scarce because the demand for copper is accelerating rapidly beyond anyone's expectation."

Additionally, the cost of grain-oriented electrical steel has nearly doubled since the pandemic, and copper prices have jumped by more than 40%. These cost hikes hit the U.S. particularly hard due to its reliance on imports.

Regional growth trends further underscore market differences:

| Region | Market Characteristics | Growth Drivers |

|---|---|---|

| North America | Aging infrastructure | Grid upgrades, renewable energy integration, replacements |

| Asia-Pacific | Fastest growing (CAGR 11.2%) | Economic expansion, large-scale projects, electrification |

| EMEA | Strong growth (CAGR 7.7%) | Power sector reforms, infrastructure updates in developing nations |

The Asia-Pacific region leads in growth, with its power transformer market expected to expand from $12.35 billion in 2024 to $18.96 billion by 2030. Meanwhile, Europe focuses on replacing old infrastructure, and countries in Africa and the Middle East are seeing demand rise due to energy sector reforms. The EMEA distribution transformer market is projected to grow at a CAGR of 9.1%, outpacing the estimated 6.9% growth rate in the Americas.

Pricing trends also reveal stark contrasts. In the U.S., small single-phase pole-mounted transformer prices have skyrocketed 100–200% since 2020, while global markets have experienced more moderate increases. Lead times for large power transformers in the U.S. now stretch to 38 months.

These regional differences, combined with material costs and supply chain challenges, paint a complex picture of transformer pricing. For businesses looking to navigate these variations, platforms like Electrical Trader offer tools to compare domestic and international transformer options, helping buyers balance pricing and availability across markets.

Power Transformer Price Forecast After 2025

The power transformer market is on a steep growth trajectory. With global electricity demand expected to surge by 150% by 2050, a $14.3 trillion investment gap looms, threatening both equipment availability and pricing. The Global High Voltage Power Transformer Market is projected to almost double in size, growing from $17.63 billion in 2024 to $32.19 billion by 2031, with a compound annual growth rate (CAGR) of 7.18%. These trends reflect ongoing challenges like supply chain delays and rising material costs, which are reshaping the industry.

Let’s dive into the factors driving this market shift, including grid modernization, smart transformer technology, and supply-demand challenges.

Grid Updates and Smart Transformers

The move toward smart grids is transforming the power transformer market. The smart transformer sector, valued at $2.89 billion in 2024, is forecasted to grow at a CAGR of 10.12% through 2032, driven by the integration of IoT and real-time analytics. These advanced systems empower utilities to optimize energy distribution, prevent outages, and save significant costs - studies estimate savings of around $15,000 per day from avoiding costly outages.

Major players are already innovating. In April 2021, Siemens introduced a digital transformer under its Sensformer portfolio, incorporating sensors and digital intelligence to enhance grid flexibility. Similarly, ABB unveiled the world’s first dry-type digital transformer in November 2021, designed specifically for offshore applications, featuring air-cooled cores and non-flammable solid insulation materials.

Although smart transformers come with higher initial costs, they offer substantial long-term benefits. For example, upgrading to high-efficiency transformers can reduce energy consumption by up to 12%, while high-efficiency conductors can cut transmission line losses by 10% to 20%. The adoption of renewable energy further accelerates the demand for these smart technologies, as they are essential for managing fluctuating inputs from solar and wind sources. By 2050, distributed energy resources could account for 45% of Australia’s electricity generation capacity, and 83% of EU households might become energy "prosumers" - both consumers and producers. Additionally, vehicle-to-grid technology could unlock nearly 600 gigawatts of flexible capacity by 2030 across major regions like China, India, the U.S., and the EU. These advancements make smart transformers a critical tool for managing bidirectional energy flows, especially as electric vehicles increasingly function as mobile energy storage units.

However, these technological strides are taking place against a backdrop of persistent supply and demand challenges, which continue to shape market pricing.

Supply and Demand Changes and Market Forecasts

The transformer market is grappling with supply chain pressures. Ben Boucher, Senior Analyst at Wood Mackenzie, emphasizes:

"Realistically, those lead time increases are not expected to improve in the near term, because their causes are amplifying."

Raw material costs remain a key driver of price increases. For instance, India faces a 30% shortage of CRGO steel, a critical component for transformers, with domestic production meeting just 10–12% of demand.

Adding to the strain is aging infrastructure. In the U.S. alone, there are an estimated 60–80 million distribution transformers, and about 55% of residential units are nearing the end of their operational lifespan, with many over 40 years old.

Regional trends also highlight varying growth dynamics:

| Region | Market Outlook | Key Growth Drivers |

|---|---|---|

| Asia-Pacific | Leading growth market (50% share) | Economic expansion, urbanization, renewable energy integration |

| North America | Supply-constrained growth | Infrastructure replacement, grid modernization |

| EMEA | Steady expansion | Energy reforms, efficiency-focused upgrades |

Overall, the power transformer market is expected to grow from $27.9 billion in 2024 to $37.7 billion by 2029, with a CAGR of 6.2%. However, rising tariffs on imported components are increasing production costs, which could lead to higher prices for consumers.

Technological advancements are also shaping the post-2025 landscape. Materials like bio-based and naphthenic transformer oils are improving transformer efficiency and lifespan, while innovations such as amorphous metal cores and biodegradable insulating oils are gaining traction. Furthermore, artificial intelligence and IoT technologies are playing a growing role in enhancing transformer capabilities.

For businesses navigating this complex market, platforms like Electrical Trader provide valuable tools to compare prices and availability across transformer types and suppliers. While material costs and supply constraints will likely drive prices higher after 2025, the adoption of advanced technologies promises improved efficiency and functionality. Companies that invest in cutting-edge transformer solutions and establish strong supplier relationships will be better equipped to thrive in this evolving market.

Conclusion: Main Findings from 10 Years of Price Data

Over the last decade, power transformer prices have soared by 70–75%, driven by a mix of rising raw material costs, surging demand, and supply chain bottlenecks.

Two key factors have shaped this price surge: raw material expenses and the growing supply-demand imbalance. Since 2021, lead times have tripled to around 150 weeks, creating significant market constraints. These challenges have pushed supplier margins to new heights. According to Wood Mackenzie, margins for power transformers have quadrupled, while distribution transformer margins have grown nearly fivefold - now accounting for about 20% of total unit costs.

Regional growth trends have also influenced the market. North America is set to retain its leadership position, projected to hold 41.7% of the global market share by 2025. Meanwhile, the Asia Pacific region is emerging as the fastest-growing market, with a compound annual growth rate (CAGR) of 11.2%. In the U.S., federal initiatives like the Infrastructure Investment and Jobs Act (IIJA) and the CHIPS Act, combined with rising demand from data centers and AI-focused applications, have further fueled market activity.

Technology has played a pivotal role in reshaping pricing trends. Energy efficiency regulations introduced around 2015 initially pushed costs higher by requiring better-quality materials and larger transformer designs. More recently, innovations like smart transformers and renewable energy integration have carved out new market segments that command premium prices.

Market forecasts point to sustained growth. The U.S. power transformer market is expected to grow from $2.9 billion in 2024 to $4.8 billion by 2032, reflecting a CAGR of 6.5%. Similarly, the broader North American transformer market is projected to expand from $18.1 billion in 2024 to $37.1 billion by 2034.

Strategic planning and strong partnerships have proven critical for navigating these challenges. Companies that have built solid relationships with manufacturers have been better equipped to manage supply constraints. Early demand commitments have also helped businesses reduce lead times and limit price volatility.

The market is evolving beyond traditional obstacles. Emerging drivers like cybersecurity concerns and the rapid growth of EV charging infrastructure add complexity to an already dynamic landscape. With aging infrastructure and new demands reshaping the industry, tools like Electrical Trader provide valuable insights, helping stakeholders compare prices across suppliers and transformer types.

The past decade offers clear lessons: businesses that prioritize supply chain resilience, embrace new technologies, and cultivate strategic vendor relationships will be better positioned to thrive in the ever-changing transformer market.

FAQs

What has caused power transformer prices to rise over the past decade?

Power transformer prices have climbed sharply over the past decade, and several factors are fueling this trend. A key reason is the rising cost of raw materials like copper and electrical steel - both critical components in transformer production. Global fluctuations in commodity markets have driven up these prices, making manufacturing more expensive.

On top of that, supply chain disruptions, geopolitical tensions, and increased costs for shipping and manufacturing have added to the financial strain. The growing demand for transformers, spurred by infrastructure upgrades and the shift toward renewable energy, has further intensified the upward pressure on prices. Together, these factors have made power transformers significantly pricier over the years.

How have supply chain issues and rising material costs affected power transformer prices and delivery times?

Supply chain disruptions have caused delivery times for power transformers to skyrocket. What used to take just 6 to 12 weeks before 2020 now stretches to a staggering 80 to 210 weeks. This dramatic shift has made project planning and execution far more complicated.

Adding to the challenge, the costs of key materials like copper, electrical steel, and insulating oil have surged, pushing transformer prices up by as much as 30% in recent years. These price hikes, combined with unpredictable lead times, are creating ripple effects throughout the power distribution market, making it harder for businesses to manage budgets and schedules effectively.

How are technological advancements and efficiency standards influencing the future of power transformer pricing and design?

Technological progress is reshaping the power transformer market, bringing smarter designs, better energy efficiency, and enhanced performance. For instance, amorphous steel cores are helping cut energy losses, while advanced smart monitoring systems are boosting reliability and providing deeper operational insights. These innovations allow manufacturers to produce transformers that perform better and are more economical over time.

Meanwhile, changing efficiency standards are adding another layer of transformation. The Department of Energy (DOE) has announced stricter energy conservation regulations set to take effect in 2027. These new rules are pushing manufacturers to explore advanced materials and designs to meet the demand for energy-efficient solutions. The goal? Lower operating costs, align with sustainability efforts, and cater to the growing U.S. market for efficient energy technologies. Together, these technological and regulatory shifts are redefining how transformers are designed and priced, blending innovation with compliance.

Related posts

- Common Transformer Problems and Solutions

- Study: Pricing Trends in Electrical Equipment Trading

- Regional Shifts in Power Distribution Equipment Demand

- New vs Used Transformers: Supply Chain Insights