Infrastructure Spending Trends and Power Equipment Growth

Share

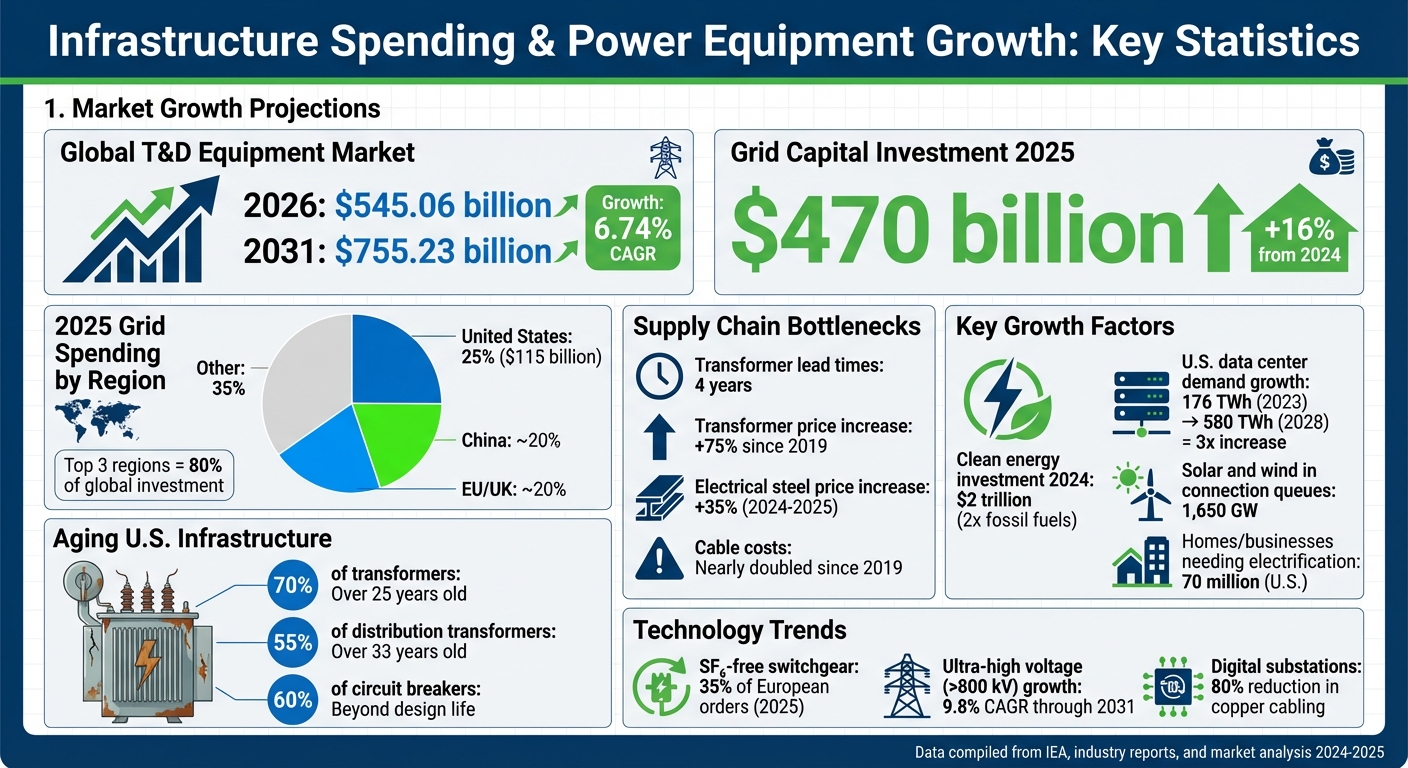

The global push for infrastructure modernization is driving a surge in demand for power equipment. By 2025, grid capital investments are projected to exceed $470 billion, up 16% from 2024. Key factors include aging infrastructure, renewable energy integration, and rising electricity needs from data centers and electric vehicles. However, supply chain challenges - like 4-year lead times for transformers and 75% price hikes since 2019 - make procurement increasingly complex.

Here’s what you need to know:

- Aging Infrastructure: 70% of U.S. transformers are over 25 years old, with failure rates expected to rise after 2030.

- Renewable Energy: $2 trillion of global energy investments in 2024 target clean energy, doubling fossil fuel spending.

- Data Centers: U.S. electricity demand from data centers is set to triple by 2028, requiring extensive grid upgrades.

- Supply Chain Bottlenecks: Rising costs for materials like electrical steel (+35% in 2024–2025) and extended lead times are straining projects.

Online marketplaces are emerging as critical tools for sourcing equipment, offering both new and refurbished options to address delays. With global transmission and distribution equipment markets expected to grow from $545.06 billion in 2026 to $755.23 billion by 2031, efficient procurement strategies are more important than ever.

Global Power Equipment Market Growth and Infrastructure Investment Statistics 2024-2031

Global Infrastructure Spending Trends

Global infrastructure investment is reaching unparalleled levels. In 2024, total energy investment is expected to surpass $3 trillion, with a substantial $2 trillion allocated to clean energy technologies and infrastructure. Clean energy now attracts nearly twice as much capital as fossil fuels, signaling a major shift in priorities. This momentum is driving significant changes in energy and power systems worldwide.

Energy and Power Systems Investment

Investment in grid infrastructure is accelerating. Solar PV alone is projected to see $500 billion in investment in 2024, while battery storage and nuclear power are set to attract $50 billion and $80 billion, respectively. The International Energy Agency has emphasized the urgency, stating, "Invest in grids today or face gridlock tomorrow".

Transmission infrastructure is expanding at nearly twice the pace of distribution networks, with a 16% compound annual growth rate (CAGR) compared to 9% for distribution. This growth is fueled by the need for long-distance connections, high-voltage direct-current (HVDC) projects, and new substations. Such advancements are driving demand for specialized equipment like high-voltage cables and large power transformers. However, challenges remain - 1,650 GW of solar and wind projects are currently stuck in connection queues due to insufficient transmission capacity. These developments highlight the critical role of technology and funding strategies across different markets.

Public and Private Investment Roles

Investment trends vary significantly by region. The United States is leading the charge in grid spending, with $115 billion projected for 2025, accounting for 25% of the global total. Meanwhile, China and the combined EU/UK each contribute about 20%, collectively making up 80% of worldwide grid investment.

The balance between public and private investment also differs across markets. In advanced economies, private investors account for 85% of energy funding. In contrast, in emerging markets (excluding China), governments and state-owned enterprises supply 50% of the capital. Interestingly, individual consumers now play a growing role, influencing 18% of total energy investments - up from 9% in 2015. This shift is largely driven by the adoption of rooftop solar, heat pumps, and electric vehicles. These evolving funding patterns are reshaping procurement and equipment availability across the globe.

sbb-itb-501186b

Key Drivers of Power Distribution Equipment Demand

The demand for power distribution equipment is being shaped by three major forces: decarbonization, digitalization, and aging infrastructure. Each of these factors brings its own set of challenges and opportunities, highlighting the need to modernize the grid to meet evolving energy needs.

Decarbonization and Electrification

The push toward net-zero emissions is reshaping energy consumption patterns. To meet climate goals, electricity's share in energy use needs to grow by 4% annually through 2030. This means replacing fossil-fuel-based systems - like gas boilers, internal combustion engines, and industrial heating - with electric alternatives such as EVs and heat pumps. In the U.S. alone, around 70 million homes and businesses must transition away from on-site fossil fuel use. Supporting this shift, U.S. investment in distribution infrastructure hit $50.9 billion in 2023, marking a 160% increase since 2003. Spending on line transformers, which reduce voltage for household use, also jumped 23% to $7.5 billion that year.

The integration of renewable energy sources adds another layer of complexity. Wind and solar, being intermittent by nature, require grid systems capable of handling bidirectional power flows - something older infrastructure wasn't designed for. As a result, spending on distribution substation equipment surged to $6.1 billion in 2023, a 184% increase since 2003. These investments underscore the need for a more flexible and adaptive grid to accommodate renewable energy.

Digital Infrastructure Expansion

The rapid growth of digital infrastructure, especially data centers, is another major driver of equipment demand. In 2023, data centers accounted for 4.4% of U.S. electricity use, a figure projected to increase to as much as 12% by 2028, with consumption rising from 176 TWh to as much as 580 TWh. This expansion requires specialized equipment like substation transformers, circuit breakers, and switchgear to maintain reliable power for these energy-intensive facilities.

Utilities face mounting pressure to keep up with this demand. Between $36 billion and $60 billion may be needed by 2030 to upgrade grid infrastructure and generation capacity. For example, in December 2024, Intersect Power teamed up with Google and TPG Rise Climate to invest up to $20 billion in renewable power infrastructure aimed at supporting new data centers and scaling clean energy by 2030. However, while building new power lines can take 7–10 years, tech companies often require faster connections, pushing utilities to adopt advanced solutions like take-or-pay contracts and upfront payments for infrastructure access. These demands are further straining an already aging grid, which struggles to support modern, bidirectional power flows.

Aging Infrastructure and Reliability Challenges

While decarbonization and digital growth are driving new investments, the aging power grid presents a significant hurdle. Much of the power distribution infrastructure in North America has exceeded its intended lifespan. In the U.S., 55% of distribution transformers in operation are over 33 years old. Additionally, 60% of circuit breakers and many other components are operating well beyond their expected design life. As Killian McKenna from the National Renewable Energy Laboratory explained:

"Assets that were expected to last 30 to 40 years are, in many cases, lasting 40, 50, and even over 60 years".

This aging infrastructure not only reduces reliability but also struggles to handle modern demands, such as the bidirectional power flows from rooftop solar or the high-density loads of data centers. With many components nearing the end of their functional life, equipment failure rates are expected to rise sharply after 2030.

To address these issues, utilities are taking steps to modernize. For instance, spending on underground cables in the U.S. more than doubled over the past two decades, reaching $11.8 billion in 2023. Upgrading old transformers with high-efficiency models can also cut energy consumption by as much as 12%. These modernization efforts are reshaping procurement strategies and driving the development of new equipment specifications across the sector.

Regional Infrastructure Trends and Equipment Impact

Regional priorities are shaping the demand for infrastructure and equipment, building on global trends. In North America, the focus lies on boosting grid resilience, replacing outdated systems, and meeting rising power needs driven by the expansion of data centers. Europe, on the other hand, is channeling investments into its green energy shift and cross-border capacity enhancements. Meanwhile, the Asia-Pacific region is leading the charge in large-scale grid expansions and ultra-high-voltage (UHV) networks.

North America

Investor-owned utilities in the U.S. are set to invest over $1.1 trillion from 2025 to 2029, with $66.5 billion earmarked for modernizing distribution grids. This investment addresses several critical challenges: replacing aging infrastructure, meeting the soaring electricity demands of expanding data centers, and bolstering resilience against extreme weather events like wildfires and storms. For instance, the electricity consumption of U.S. data centers is projected to triple, climbing from 176 TWh in 2023 to 580 TWh by 2028.

Efforts to modernize are already underway. In December 2024, the Midcontinent Independent System Operator (MISO) announced a $22 billion initiative to install high-voltage transmission lines across the Midwest to support growing load demands and improve reliability. Similarly, Dominion Energy has accelerated voltage-support projects in Loudoun County, Virginia, to accommodate dense clusters of data centers. The pace of replacing outdated infrastructure is picking up, with notable projects like Minnesota Power's 224-mile, 500-kilovolt Great Northern Transmission line, completed in 2020, connecting to Canadian hydropower plants. Between 2019 and 2020, MISO completed over $5 billion in transmission upgrades aimed at replacing aging assets. Investment in overhead infrastructure alone reached $17.4 billion in 2023, marking a 220% increase since 2003. By 2025, replacement activities are expected to account for 58.4% of global transmission and distribution installations.

Europe

Europe's infrastructure investments are heavily influenced by its green energy goals, supported by initiatives such as REPowerEU and ambitious decarbonization targets. The European Union's F-Gas regulation, which calls for a 79% reduction in SF₆ inventory by 2030, has accelerated the adoption of eco-friendly, SF₆-free switchgear. By 2025, products like ABB AirPlus and Siemens Blue GIS made up 35% of orders, highlighting the region's dedication to environmental standards.

Cross-border connectivity is another key focus. For example, in July 2025, Siemens Energy was selected as the preferred bidder for two HVDC converter stations as part of the £2.5 billion Eastern Green Link 4 subsea project, connecting Scotland and England. Additionally, Europe is adopting digital substations that adhere to IEC 61850 standards. These substations replace traditional copper wiring with fiber-optic networks, cutting installation labor by 40% and reducing copper cabling by up to 80%, while also enhancing grid automation and cybersecurity.

Asia Pacific

The Asia-Pacific region accounted for 46.1% of the global transmission and distribution equipment market in 2025, with a growth rate of 8.2% CAGR, making it the fastest-growing region worldwide. This growth is fueled by major UHV network projects, especially in China, and ongoing rural electrification efforts in Southeast Asia and India. For instance, in 2025, China State Grid commissioned 3,500 circuit-kilometers of UHV corridors, including ±1,100 kV backbones designed to transport remote wind and solar power with losses of less than 3%.

The region's rapid urbanization and industrial expansion are also driving demand for specialized equipment. Large industrial loads, such as green-hydrogen electrolyzers and manufacturing facilities, are increasingly requiring direct 220 kV interconnections, bypassing traditional grids. This shift calls for custom transformers equipped with harmonic filters and rectifier transformers, which cost roughly 20% more than traditional industrial ratings. Other essential equipment includes 1,000 MVA transformers, ±800 kV Gas-Insulated Switchgear (GIS) bays, and composite insulators capable of managing extreme voltages over long distances.

| Region | Primary Spending Drivers | Key Equipment Demand | Growth Rate |

|---|---|---|---|

| North America | Data centers, aging infrastructure, resilience | High-voltage transformers, digital relays, advanced conductors | 5–6% CAGR |

| Europe | Green energy goals, SF₆ phase-out, cross-border capacity | SF₆-free switchgear, IEC 61850 digital substations, HVDC converters | 5–6% CAGR |

| Asia Pacific | UHV projects, rural electrification, industrial growth | 1,000 MVA transformers, ±800 kV GIS bays, composite insulators | 8.2% CAGR |

Future Outlook: Power Equipment Growth and Market Dynamics

Growth Projections by Scenario

The global market for transmission and distribution equipment is expected to grow from $545.06 billion in 2026 to $755.23 billion by 2031, reflecting a compound annual growth rate (CAGR) of 6.74%. Current global policies project annual transmission investments to reach $200 billion by the mid-2030s, with more ambitious climate targets requiring $250–$300 billion annually. Ultra-high-voltage equipment exceeding 800 kV is forecasted to grow at a 9.8% CAGR through 2031, largely driven by China's ongoing development of ±1,100 kV transmission corridors. Meanwhile, high-voltage assets within the 35 kV to 220 kV range, which held 43.1% of the market share in 2025, are anticipated to remain critical for distribution networks, especially in North America and Europe.

Technology trends are also reshaping the market. For instance, SF₆-free switchgear accounted for 35% of European orders in 2025, aligning with the EU's F-Gas regulation, which targets a 79% reduction in SF₆ inventory by 2030. Digital substations, built to IEC 61850 standards, are now becoming the norm, reducing copper cabling needs by 80% while improving cybersecurity and fault management. A notable innovation came in July 2025, when ABB Ltd. introduced the SACE Emax 3 air circuit breaker, tailored for AI-driven data centers. This product integrates zero-trust cybersecurity measures and predictive-maintenance capabilities. Such advancements highlight how industrial electrification - particularly in sectors like hyperscale data centers and green-hydrogen facilities - is driving demand for transformers that cost about 20% more than traditional models.

However, supply chain constraints remain a significant hurdle. Extended lead times and rising costs are pushing utilities to rethink procurement strategies. For example, grain-oriented electrical steel, a key material for transformer cores, saw its price climb by 35% between 2024 and 2025. To address these challenges, utilities are turning to long-term procurement agreements and standardized equipment specifications to better manage capacity planning. As the International Energy Agency (IEA) emphasizes:

"The visibility and credibility of national and regional transmission plans, and their translation into component demand, is vital to underpin investment decisions to expand manufacturing capacities".

These evolving conditions call for innovative approaches to procurement to sustain infrastructure development.

Role of Marketplaces in Equipment Procurement

Traditional procurement methods are struggling to keep pace with fluctuating lead times and price volatility in the power equipment sector. To adapt, utilities and contractors are increasingly turning to online marketplaces for sourcing both new and refurbished equipment. Platforms like Electrical Trader provide centralized access to a wide range of power distribution components, including breakers, transformers, and high-voltage systems.

The market for used equipment has become especially important, as replacement projects accounted for 58.4% of global transmission and distribution installations in 2025. When delays in new equipment procurement occur, refurbished units help maintain operations until permanent replacements are ready. These marketplaces also make it easier for smaller contractors to access equipment by bypassing the often-complex requirements of manufacturers. For example, as utilities like American Electric Power divest non-core assets to fund grid modernization - such as the May 2024 sale of AEP OnSite Partners to Basalt Infrastructure Partners - secondary markets provide a practical way to repurpose equipment that is no longer strategically critical but still functional.

The rise of modular and decentralized infrastructure is further driving demand for flexible procurement solutions. Projects like microgrids, virtual power plants, and direct industrial interconnections often require non-standard configurations sourced from multiple vendors. Digital marketplaces simplify this process by aggregating inventory across suppliers and offering transparent pricing. With grid capital spending projected to surpass $470 billion in 2025, a 16% increase from the previous year, efficient procurement systems are becoming a cornerstone of infrastructure expansion.

Conclusion

The surge in global infrastructure spending is reshaping the power equipment market in profound ways. By 2025, grid capital spending is expected to surpass $470 billion - a 16% jump from the previous year. This growth is fueled by aging infrastructure (with nearly 70% of U.S. transformers over 25 years old), the rapid expansion of data centers projected to add 44 GW of demand by 2030, and ambitious decarbonization goals that will require $250–$300 billion in annual transmission investments by the mid-2030s.

However, supply chain bottlenecks remain a major hurdle. Lead times for large power transformers now extend up to four years, transformer prices have soared by 75% since 2019, and grain-oriented electrical steel prices are set to rise 35% between 2024 and 2025. On top of that, cable costs have almost doubled since 2019. To navigate these delays, utilities are increasingly adopting dual-sourcing strategies and reserving production slots to ensure timely access to critical components.

In this challenging landscape, streamlined procurement channels have become indispensable. Online marketplaces, such as Electrical Trader, are stepping up as vital resources, offering centralized access to new and refurbished equipment. These platforms help contractors and utilities cut through extended lead times and manage fluctuating prices. For smaller contractors, the flexibility and simplicity these marketplaces provide are especially valuable, eliminating many of the hurdles posed by traditional procurement processes.

As the grid continues its modernization journey, the demand for transparent and efficient procurement systems will only grow. With record investments, ongoing supply constraints, and the push for advanced grid technologies, specialized marketplaces are positioned to play a crucial role in connecting industry professionals to the equipment needed to meet the demands of expanding infrastructure.

FAQs

What challenges are impacting the power equipment supply chain today?

The power equipment supply chain is grappling with rising costs and delays, making it harder to meet growing demands. Prices for essential components like transformers, high-voltage cables, and switchgear have nearly doubled since 2021. Inflation and shortages of raw materials are the main culprits. On top of that, procurement lead times for these items have stretched significantly, slowing down grid expansion projects.

Adding to the strain is the surging demand for power distribution equipment. The rapid growth of renewable energy projects, data centers, and AI-driven technologies has outpaced the manufacturing capacity for high-voltage equipment. This mismatch between supply and demand has pushed costs even higher and caused longer delivery times, creating serious bottlenecks in infrastructure development.

Platforms like Electrical Trader offer a way to tackle these challenges. Acting as centralized marketplaces, they connect utilities, contractors, and end-users with a variety of suppliers. This not only helps shorten lead times but also provides a way to manage price fluctuations more effectively.

How does aging infrastructure affect the reliability of the U.S. power grid?

Aging power grids in the U.S. are struggling to keep up with today’s energy demands and the surge in electrified technologies. Shockingly, around 31% of transmission lines and 46% of distribution systems have outlived their intended design lifespan. This aging infrastructure is more vulnerable to failures, outages, and voltage drops, increasing the risk of widespread power disruptions.

To tackle these pressing issues, utilities are focusing on grid modernization efforts. This includes replacing or refurbishing outdated components such as transformers, breakers, and conductors. Platforms like Electrical Trader are stepping in to streamline the process, helping utilities, electricians, and contractors quickly source essential power-distribution equipment. These tools are crucial for maintaining grid reliability while upgrading systems to meet modern standards.

What is driving the growing popularity of online platforms for power equipment procurement?

The growing demand for power distribution equipment, driven by large-scale infrastructure investments in the U.S. and around the world, has turned online marketplaces into a key resource for procurement. With U.S. electricity consumption projected to increase by about 3% each year and substantial funding flowing into renewable energy projects, buyers are feeling the pressure to secure equipment both quickly and efficiently.

Online platforms make this process much easier by consolidating inventories of both new and used equipment like breakers, transformers, and switchgear. These marketplaces save time by providing immediate access to product details, availability, and pricing - all in one place - cutting down on the need to rely solely on traditional dealers. For U.S. buyers, they also offer a practical way to manage budgets, handle price changes, and meet tight deadlines, making them an indispensable tool for modernizing and expanding the grid.